Honduras 2024/2025 in a nutshell

IHCAFE estimates that the 2024/25 coffee crop will reach 7 million quintals of 46 kilos, marking a 5–7% decrease compared to last year. The drop is most notable in lower-altitude areas (below 1,100 m), which are battling challenges like leaf rust, defoliation, and a lack of maintenance. Meanwhile, higher-altitude farms remain productive, with good quality coffee on offer.

November exports are up 7% compared to 2023, with the number of contracts increasing by 11%. However, the harvest has been delayed by a month, peaking in December due to the climate. Many regions experienced just one flowering, raising concerns about workforce shortages as coffee ripens all at once.

Why demand is now moving to Honduras

The story begins with delayed Ethiopian shipments driving demand for Peruvian coffees earlier this year. But contract defaults in Peru have now redirected attention to Honduras. This domino effect is the result of a tight balance between global supply and demand: coffee consumption has outpaced production in four of the last six years, leading to shrinking warehouse stocks.

News from Honduras are mixed. The harvest delay caused by heavy rains brings potential bottlenecks, especially when it comes to the workforce. IHCAFE’s lowered production estimate reflects difficulties in lower-altitude areas, where rain, overwatered beans, and leaf rust have hit hardest.

“Low-altitude farms are struggling more,” says Bernard Ornilla of GAIA, a 3.5-hectare farm in Lempira. “Beans are cracking from too much water, and workers won’t pick in heavy rain.”

Low altitude x high altitude

Fortunately, the picture looks very different in higher-altitude farms. “In the Occidental zone near Guatemala and El Salvador, there’s more coffee compared to the middle of the country,” says Melany Madrid of PROEXO in Copán. “Buyers who visited us said there was nothing in other areas.”

Sebastian Wiersma of Cafesmo agrees: “Most of our farmers are above 1,260 m. We’ve had more rain than usual for this time of the year but the harvest loss is negligible and there’s no damage to infrastructure. Farmers are also not complaining about leaf rust here.”

A liquidity crisis

While the weather’s been “clement”, there are two important challenges this year. Labour shortages, worsened by migration, and lack of access to financing are being felt from border to border.

“Banks are sceptical about loans,” explains Sebastian. “Some organisations went bankrupt this year. Even for us, who managed to pay all our debts, the bank now demands proof of stock before extending credit. Thankfully, we have alternatives like Algrano’s Grower Capital and social lenders like Fair Capital.”

According to Bernard, the financing crisis has been building for two years. “Banks used to advance payments for producers, but now they’ve pulled back. This has impacted the whole sector.”

There were times when local prices outpaced the New York price, and organisations struggled to fulfill their contracts. Bernard also pointed out a change in the management of Banco de Occidente, a leading institution in coffee finance.

“The founder, who was from Copán, retired three years ago. When his son took over, he tightened lending policies, and you can only get credit if you have assets. Long-standing clients with 10–15 years of history were denied loans because of performance.”

Lack of financing becomes an even bigger problem when local prices are higher, as they are now. “There’s a comfort in knowing that farmers are getting reasonable prices. But I also find it worrisome because we need a lot more money to buy coffee,” Sebastian reflects. “What happens if prices go down?”

Competing with middlemen

In this climate, multinational companies with access to cheap credit have a clear advantage. They can wipe the market clean. For Melany of PROEXO, the bigger risk is “when middlemen come and offer much higher prices”, destabilising the sector.

PROEXO has competitive payment policies, including an additional 10% on delivery and a premium after the harvest plus micro-finance and other benefits. Yet, aggressive buying practices from middlemen threaten the sector’s stability—and they don’t offer producers long term support or benefits.

Certified and specialty coffees face fewer disruptions, but organisations selling conventional coffee might struggle. Melany believes when the EUDR regulations come into force in 2025, middlemen will be forced to ensure traceability, reducing their market share. “I hope in five or ten years, they’ll be gone,” she says. For now, she warns there are many new organisations popping up to take advantage of high prices.

November exports and labour issues

On the demand side, November export figures are up by 7% compared to 2023 and that number of contracts are up by 11%, with certified coffees holding steady. However, current market prices are driving buyers towards Rainforest Alliance and Organic coffees instead of Fairtrade, as there's a higher premium requirement.

Labour issues, a known hurdle in Central America, remain. “Pickers are earning $2.80 per gallon compared to $2.40 last year,” says Bernard. “While some farms are investing in maintenance, others are letting go. Labour costs make expanding coffee planting less appealing, even at current prices.”

There’s also concern about Donald Trump’s promise to act on a mass deportation plan when he takes office in 2025. “26% of all the money Honduras receives in a year comes from remittances. I have no idea what’s going to happen if there’s a mass deportation—but the impact on the economy could be huge,” Sebastian reflects.

Bernard is somewhat skeptical. “Last time Trump was elected many Hondurans kept going into the United States. It was the opposite of what people expected.”

Until that happens, however, the main fear is of a possible harvest “pile up” in December and January. “There was only one flowering in many regions because it didn’t rain at the right times. We could see a big peak of coffee being harvested in December and January, making the workforce problem bigger,” says Bernard.

Choosing strong partners at origin

Honduras is entering the new coffee cycle with the potential for increased revenues unlike most years, when prices drop after the harvest in Brazil. While there’s no sign of Peru-style defaults, Bernard advises roasters to choose their partners well. “Be careful who you work with.”

For roasters, it’s vital to make sure you work with organisations that are financially stable and have access to alternative financing—not just local banks. For one, all verified sellers on Algrano can access our Grower Capital program, offering lower interest rates than commercial banks and quick turnaround times. It’s a way to improve producers’ cash flow and help them fulfil contracts.

Important dates

Sample availability

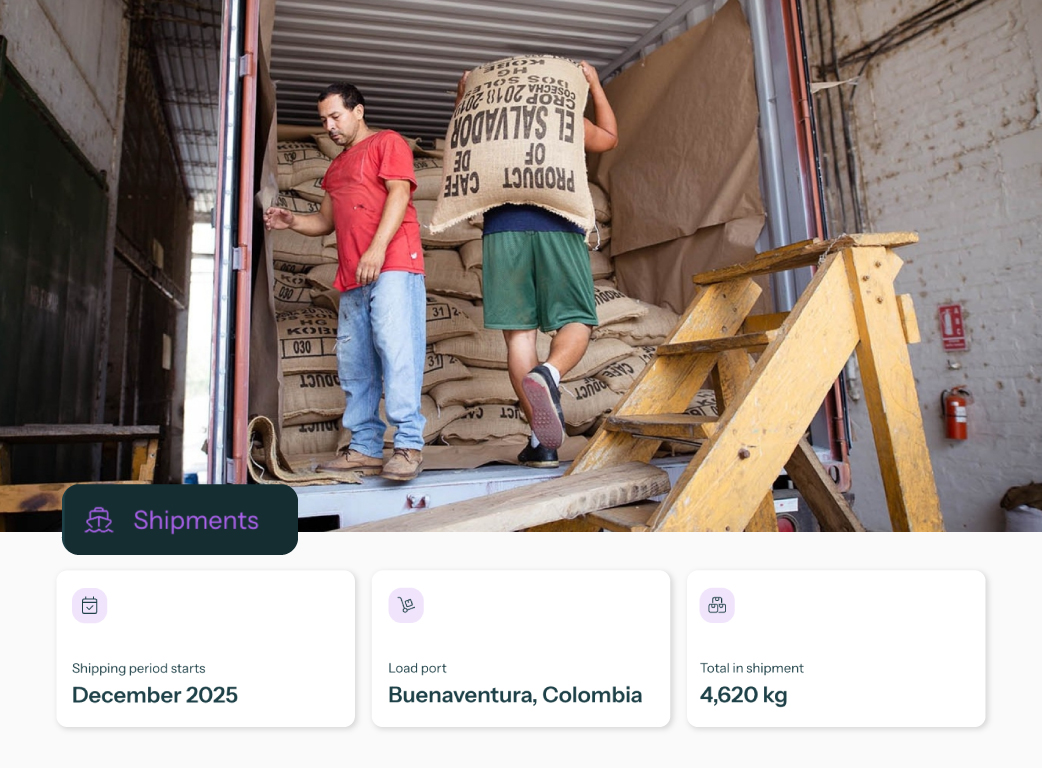

Shared shipments

Vollers Bremen - Germany

Two consolidated shipments closing in April and June

Release from August and October

One COMSA shipment closing in June

Release from October

Vollers Bury, St. Edmunds - UK

One COMSA shipment closing in June

Release from September

Annex, Alameda, California - USA

One consolidated shipment closing in May

Release from August

Custom shipments can be scheduled at the times that suit you best, starting in March.

.png)