Discover how European coffee roasters in the specialty segment are thinking about the quality, price, and traceability of the coffees they’re buying in a year marked by a rise in e-commerce sales and consumers’ coffee knowledge.

.png)

This overview of the European market was written by independent consultant Stuart Ritson, covering purchase preferences, pricing preferences for different quality bands, the importance of the producer story, and how roasters want to connect with producers.

Key trends in Europe’s coffee market

.png)

• Cup quality is the single most important factor in coffee purchases.

• Brazil, Colombia and Ethiopia are the main suppliers for specialty roasters in Europe.

• 2020 saw a huge rise in e-commerce sales, with 400% growth in e-commerce retail.

• A rise in home user skill and experience is expected to boost demand for higher quality.

• Specialty coffee can be priced up to US$12,00/kg before any additional marketing considerations have to be made. Beyond this, the audience for coffee drops sharply. Beyond US$25,00/kg, producers should consider the marketability of their coffee.

• The areas of greatest potential for investment by coffee producers and exporters are rare varieties and female coffees. Anaerobic methods and young producer lots also seem to be growing.

• Roasters care about fair prices but are not confident that their partners are paid well.

About the report

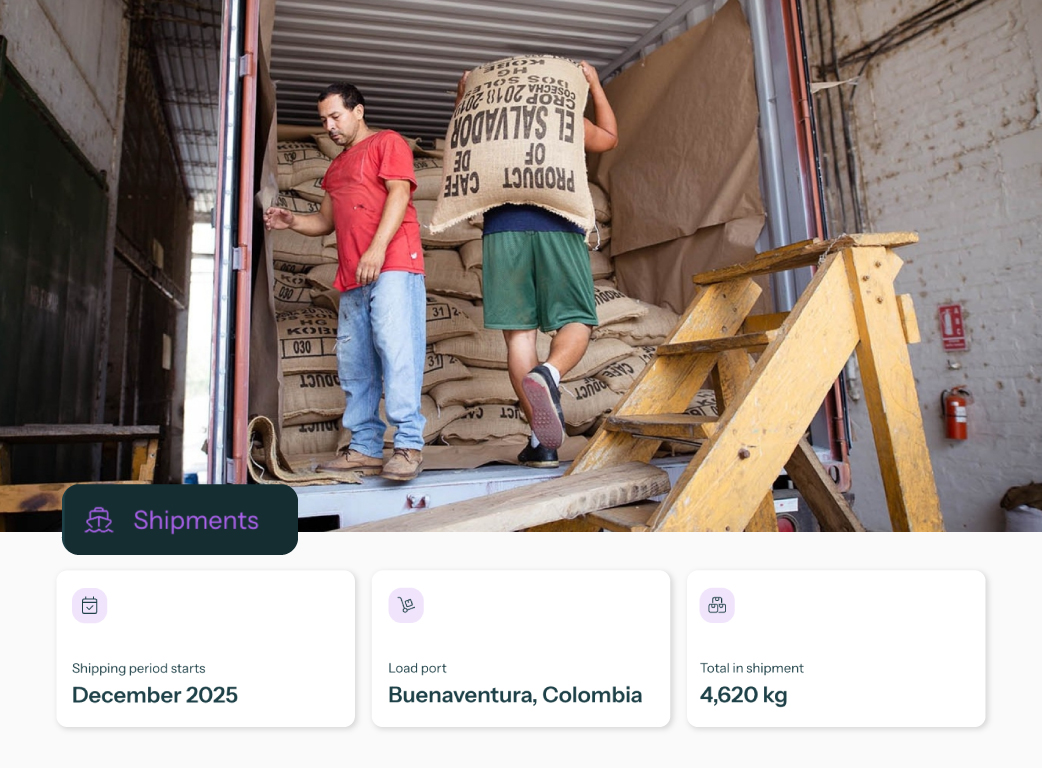

The report was written to provide insights about European coffee roasters to producers all over the world. Historically, information flows only from producing countries to buyers. Producers rarely knew about the behaviours and preferences of their buyers. Now, by surveying and interviewing roasters across Europe, Algrano is helping buyers share information back to origin.

Live panel talk at London Coffee Festival

Hear what the industry has to say about the report and dive deep into coffee sourcing and trade with Old Spike Coffee Roastery, Quarter Horse Coffee, Edelweiss Coffee Estate, and JUMARP.

.png)