This is a guide to the context of organic coffee production in Brazil. It also introduces the partnership of APAS Coffee in the South of Minas Gerais and Kaffeemacher in Switzerland. It shows how the roastery is encouraging organic production and having a positive social and environmental impact on the lives of its suppliers.

In this article:

- What's the history of organic coffee production in Brazil?

- Why the country’s first attempt to produce organic in the 90s was a disaster?

- What makes organic coffee from Brazil expensive when conventional is cheap(er)?

- What are the production costs of organic coffee and how do they compare to conventional?

- What are the challenges to producing organic coffee in Brazil?

- Why it’s important to buy coffee in transition to organic?

Organic Brazil: only 150,000 bags a year

Brazil dedicates nearly 2.5 million hectares of land to coffee production, three times more than Colombia, the world’s second-largest Arabica-producing country. Yet, only 4.500 hectares are certified organic. In other words, only 0.2% of all planted areas in Brazil are organic.

Data about Brazil’s overall coffee production is released weekly to the public by Conab (Brazil’s National Supply Company). Yet data on the volume of organic coffee produced in Brazil is not even formally collected. There are only guesstimations.

Cassio Franco Moreira, an agronomist with a PhD in Agroecology and CEO of ACOB (Brazilian Association of Organic and Sustainable Coffees) estimates that the country currently produces only 150 thousand bags of organic coffee per year. Another mere 50 thousand bags are in transition.

Just 0.2% of the land and 0.3% of the volume

.png)

Compare that to the 50 million bags produced in the 2022-2023 harvest and you get to 0.3%. With the demand for organic food and drinks growing globally - Europe’s organic coffee imports grew 6.7% from 2019 to 2020 - why is it that Brazil produces so little organic coffee?

Before I answer this question, let me put things into perspective. Because Brazil is not alone. Globally, organic coffee production still represents a small share of the total output. Only 6.7% (about 745 thousand hectares) of coffee’s global cropland is organic.

The reality is that the production of organic foods worldwide is not growing at the same pace as demand. Especially since the COVID-19 pandemic. Brazil could be doing a lot more, though. Ethiopia, for example, is eight times smaller and has 40 times more land growing organic coffee.

To understand the state of organic coffee production in Brazil I’ll go back into the country’s history and cover its specific challenges. I’ll also discuss the case of APAS (Alto da Serra Producers' Cooperative).

APAS produces the coffee beans that Kaffeemacher - a roastery in Basel, Switzerland - roasts for their main espresso. The coffee is currently in transition to organic. And despite lacking the certification, Kaffeemacher is already paying the cooperative a price premium.

"I used to buy coffee from a different organic producer but I didn’t want to end up with many Brazilian coffees that tasted the same. I wanted to make it simple. When Maurício said he could transition] to organic, I asked Eli [Blaich, Sourcing Manager at Algrano] to facilitate a meeting. It was important to get the details right. That was the first time we did a futures contract."

Philipp Schallberger | Co-founder of Kaffeemacher

History of organic coffee in Brazil

Organic coffee farming emerged in Brazil in the mid-1990s and gained momentum in 1998. That year, the 1st International Conference on Fairtrade and Organic Coffee was held in the town of Machado, Minas Gerais. “When it started, producers were motivated by ideology,” says Cassio.

Shortly after, the motivation changed. Historical ICO data shows the average price for unroasted coffee dropped 54% between 1998 and 2001. Then, the C price for Brazilian Naturals was only 50,70 cents of dollar per pound. That’s one-quarter of today’s price!

.png)

“There was a very strong crisis at the time,” Cassio starts. “Many producers, desperate about the low commodity prices, wanted to add value to their products. And the market for specialty coffee was really small back then.”

For the most part, organic farming was a strategy to increase the prices paid for coffee. And production levels were good at first. According to Cassio, the residue of the chemical inputs used until then kept coffee trees productive for a couple of years.

“Lazyganic”: a short-lived story of success

.png)

Between 2022 and 2004, Brazil produced 300 thousand bags of organic green coffee. Farmers were optimistic. But it didn’t last. If Brazil lacks agronomists with expertise in organic production today, they were virtually nonexistent in the early 2000s.

“Those who started growing organically only because of the financial aspect and didn’t do proper farm management saw their plantations die within three years. It was a disaster. Producers were left traumatised,” says Cassio.

The agronomist calls the period’s farming method “largânico” in Portuguese, which translates roughly to “lazyganic”. It’s a devil-may-care approach. Cassio remembers producers used to say “You just leave it there, don’t use any inputs, and sell it for more money later on”.

On top of that, coffee producers struggled to find buyers for their coffee. Unlike Peru or Honduras, Brazil didn’t have a national strategy to promote organic exports. Market prices began to recover, breaching the US$1,00 per pound mark in 2007.

With less quality and smaller yields, most producers went back to chemicals. The volume of organic coffee production went down to around 70 thousand yearly bags. And it stayed like that for over a decade.

Why is organic Brazil so "expensive"?

.png)

Brazil has a reputation for producing cheap coffees chosen by most roasters as the base of blends. The size of the plantations and the mechanised style of production allow farmers to produce big volumes and dilute their costs, offering more affordable beans.

The country is also one of the few where many producers can be profitable when selling coffee at the commodity price. An economy of scale was essential for Brazil’s success in coffee. But it also created an expectation in consumers that all Brazilian coffee should be cheap, including organic.

“In Brazil, a farmer can be very productive with conventional production. You can get 50 to 60 bags per hectare,” says Cassio. To grow coffee organically is to give up the benefits of conventional farming. The agronomist refers to this as a high opportunity cost.

In economic thinking, opportunity cost is the potential value you lose when you choose one option over another. It’s the trade-off. The opportunity cost of organic coffee is high because producing and selling conventional coffee is easier. It’s easier to be profitable.

Certified coffees have a liquidity problem

.png)

To make organic coffee production interesting for Brazilian producers, the price premium has to compensate for the extra effort and investment. But don’t get me wrong: coffee producers worry about climate change and suffer its reality daily.

Despite the small organic production, Brazil has the largest certified coffee area in the world. There are 517 thousand hectares of 4C-certified coffee in the country. The 4C checklist covers economic, social and environmental aspects of production, from forced labour to climate change mitigation and reduced use of pesticides.

In theory, the price premium for organic coffee in Brazil ranges from 30% to 50% for non-specialty beans and from 75% to 150% for specialty. But in reality, if producers don’t manage to sell the coffee as certified (which happens a lot), they won’t get it.

The productivity of organic coffee farming is also wildly variable. Some growers produce as much on organic plots as they do on conventional ones. But others have a yield of 10 or 15 bags per hectare. In 2022, the average yield for conventional was 31.83 bags/ha.

Cassio explains that the technology to improve organic production needs refining to the terroir. And it takes time. “Conventional production is a lot more homogenous. Organic is different. You need to understand your technological package and have a team that is very switched on to it.”

The opportunity costs also involved other factors. “In the conventional system, you have a lot of inputs on offer, a lot of technology available and liquidity,” says Cassio.

“I can sell conventional around the corner every day. In the organic market, the trader only commits when the final buyer confirms… It’s slow. You get paid after you export and you’re exposed to currency fluctuations.”

Does it cost more to do organic in Brazil?

.png)

Coffee production systems in Brazil are super diverse. Just to mention a few: you have big farms and small farms, flat plots and mountainous plots, irrigated and not irrigated. This means that the costs of producing organically are also diverse.

“In general, and especially in the mountains, organic demands more labour. Even on flat plots, you will spend more on weeding,” says Cassio. “In the early days of conversion, if your soil isn’t rich in organic matter, you need to add it. And you need people to bring the bags in.”

The agronomist compares the production of Brazil with Peru and Mexico, two of the largest producers of organic coffee in the world. “There, you have an extractive system within the forest. It’s almost organic to start. So there is no significant change in the context of production.”

In countries like Mexico, Peru and Honduras, organic coffee is produced by smallholders, with around 3 hectares of plantation. They sell parchment to cooperatives, who then sell it to international buyers.

Though we can have an idea of how much producers get paid (on average), we don’t know if they are profitable. Other than Fairtrade’s Living Income Reference Price for Coffee from Colombia, there is little data on production costs and yields, let alone farmgate prices.

We suspect a lot of the organic coffee produced by smallholders is purchased below or at cost. This is why Cassio is so concerned about consumers’ perception that organic coffee from Brazil is too expensive.

“Consumers must be prepared to pay more. If production increases and the price drops, it won’t be sustainable for many farmers.”

>> See ICO Data on Prices Paid to Coffee Producers.

>> Access Fairtrade's Living Income Reference Price for Coffee from Colombia.

The case of Kaffeemacher and APAS Coffee

.png)

APAS’ recent investment in organic coffee was driven by the partnership between the cooperative and Kaffeemacher. “We started a project on organic coffee in 2018 but the boost came last year,” says the cooperative’s president Maurício Hervaz.

At that point, organic was just another product APAS wanted to offer, the same as specialty or Fairtrade. It was a differentiator to help open new doors. “We were selling 100% of the volume to another cooperative certified as both Fairtrade and Organic,” Maurício remembers.

In 2021, he secured technical assistance in organic to attract producers and convert conventional ones. It all came as a result of the partnership. “Philipp [Schallberger, Kaffeemacher’s co-founder] said he wanted to be 100% organic in the future but he still wanted to work with APAS. Then he asked if that was something we could work on.”

APAS started with seven organic coffee farmers and now there are 15. Others, including Maurício himself, have plots in transition. The cooperative’s challenge is to prove that organic can be productive and fetch better prices. Producers must see it to believe it.

Challenges of organic coffee production

.png)

The cooperative is based in the Mantiqueira de Minas, a mountainous terroir that has a cool climate and fewer problems with pests. But production is also more labour-intensive. “We are seeing folks in the mountain that are producing the same amount. But we also know of many natural products we can use in organic farming these days.” Gone are the “lazyganic” days.

According to Maurício, the hardest part of the job is managing weeds and grass. “You need to spray the farm more times because biological inputs against pests and diseases don’t last as long as chemical ones,” he says. Instead of one dose of input, farmers might need two or three.

The farmer explains that organic inputs tend to be more expensive than chemicals. And demand for them is also growing among conventional farmers. “People are seeing that organic products are good. Bacillus subtilis is an example. Folks have been using it a lot against leaf rust.”

Production costs: organic vs. conventional

.png)

To show how the costs of organic coffee production in Brazil compare to those of conventional farming, Maurício sent us a table with his main costs during the harvest. These are specific to him, a medium-sized farmer in the South of Minas Gerais.

The table below shows that growing organic coffee costs Maurício nearly 60% more than growing conventional.

Converting the total cost per hectare to cost per kilo, you’ll find that one kilo of conventional green costs US$2,43 (yield: 31.83 bags/ha). And one kilo of organic costs US$5,96 (yield: 20 bags/ha).

This is before administrative expenses, exporting costs and taxes. If you consider the FOB to the farmgate ratio in Brazil is 85%, the cost of one kilo of organic coffee ready to ship in the port of Santos is around US$7,00.

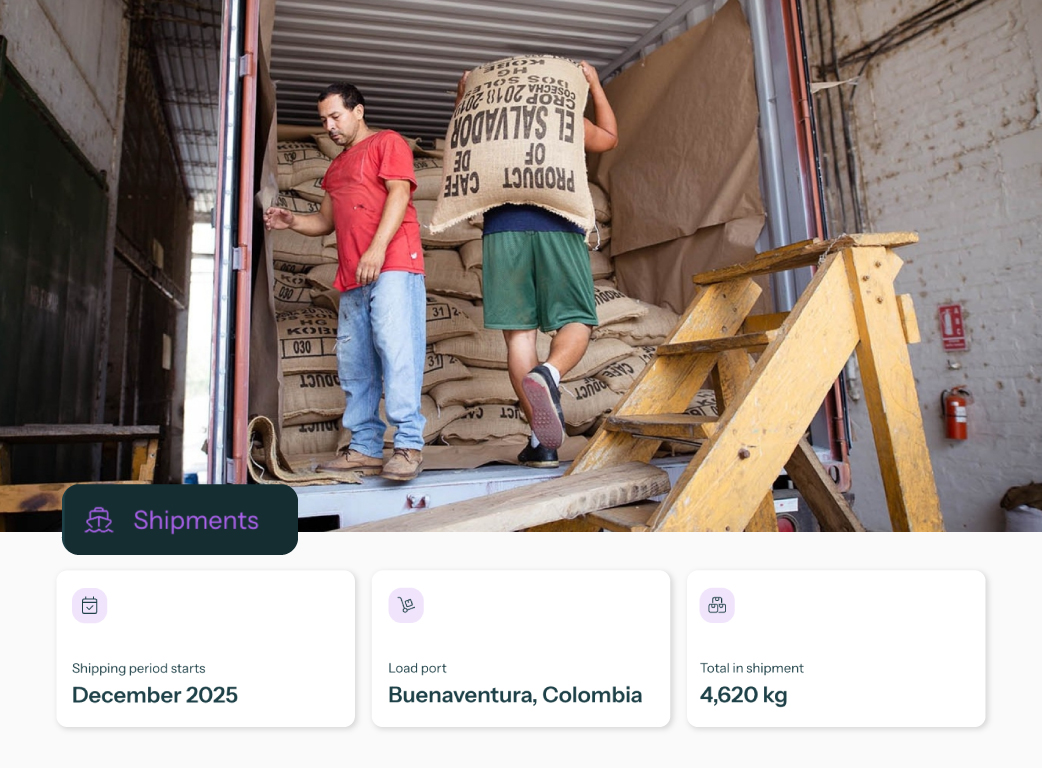

Kaffeemacher: buying coffee in transition

.png)

Most conventional coffees sold by APAS on Algrano are priced under US$ 7,00/kg FOB. If Kaffeemacher hadn’t decided to pay a premium price for their transition coffee (every producer in transition has to wait three years to become certified), they would probably be making a loss.

Cases of coffee roasters willing to pay certification premiums to producers during the period of conversion are rare. I don’t believe there is an official percentage for it, but I wouldn’t be surprised if it was as rare as organic coffee from Brazil itself.

If consumers hope to have more organic coffee in the future, incentivising this production in Brazil is essential. Producers need economic viability to bring the opportunity cost down. As Maurício said, they need to see it to believe it.

Brazil has the size and the scale to lead organic coffee production. Yet, the entire supply chain has to be on board down to the final consumer. “What Kaffeemacher is doing is to incentivise new coffee producers to start and existing ones to continue growing organic,” says Maurício.

Finding the point of balance for the roastery

.png)

“We’re either very bold or very stupid,” says Philipp. Changing their main espresso to organic in a period of high inflation is a bit of a shot in the dark for the roastery. “Our customers in Germany drink 75% APAS and it will become more expensive. Let’s see what happens.”

It’s difficult to sell sustainable coffee in general because consumers find the labels confusing. Studies suggest “people are willing to pay US$1.36 more for a pound of coffee that’s produced in an eco-friendly way and are especially partial to coffee that’s labelled ‘Organic’”.

To cover themselves, Kaffeemacher is bringing an organic Robusta from Macenta Beans, Guinea, which is “organic by default”. As Robusta is cheaper, they’ll still have an espresso at the old price and will broaden their portfolio.

The roastery also shared a video about APAS' transition to organic on their YouTube channel to test the waters. The response has been incredibly positive.

One viewer said “I am sure that your customers would support a price increase, and it would be absolutely justified in that case. It's really great how transparent you are on these issues!”

For Philipp, supporting APAS (they even pre-financed the coffee through Algrano!) is a matter of living up to what they say. “The biggest carbon emissions in coffee are in production. We have to look into this. I’m fed up with just looking into what kind of plastic bags we use.”

Kaffeemacher’s margin will take a hit with this coffee even with a €1.00/250g price increase. “But it’s a strategic coffee.” To make sure the roastery’s finances are healthy, Phillip introduced a number of changes, such as:

- He got a bigger roasting machine so they could roast more coffee in less time.

- He reduced the in-between-batch time by 1 minute to roast at least one more batch per day.

“This is the first time we’re shooting in the dark,” says Philipp. “But there is momentum to go fully organic now and gain credibility.”

Climate change is more pressing now than in 2007. The industry can’t afford to sponsor a second disaster in organic production in Brazil. Not only due to the losses and trauma suffered by coffee farmers. But because we either go sustainable now or…

.png)