’Going direct’ is often seen as the gold standard in specialty coffee. But for producers, financial sustainability isn’t just about quality. It depends on how they access the market and whether they can consistently secure prices and volume that reflect the real value of their work.

That’s the story explored in the Filter Stories podcast. Through the voices of Brazilian producers, it sheds light on the complexities of going to market—and how traditional export channels, still tied to the C-market, often fall short in delivering fair returns, even in one of the most professionalised coffee origins.

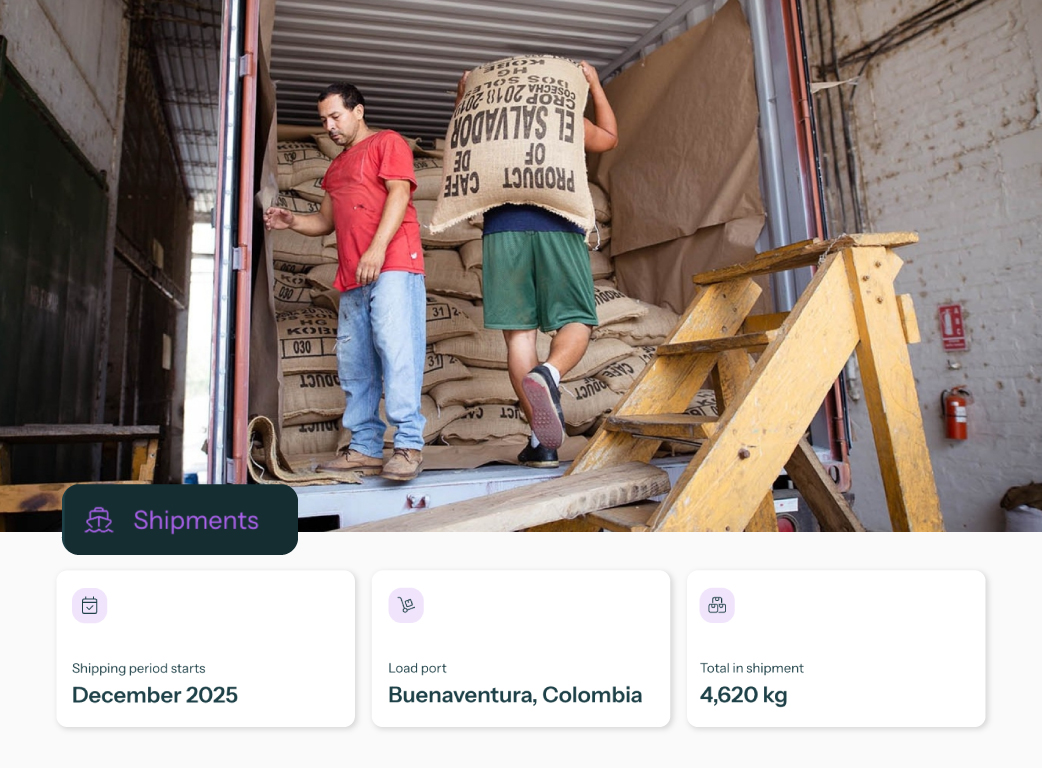

Platforms like Algrano are helping change that. By giving producers more control over pricing, visibility, and sales relationships, they open the door to long-term sustainability. Not just for a coffee, but for the entire farm.

The people behind your coffee

The podcast follows two producers at different stages of the same journey: Fazenda Paradiso, a small, family-run farm led by Vicente Pereira and featuring his daughter Marina; and Sancoffee, a well-established cooperative headed by CEO Fabricio Andrade. Both are working to grow outside of traditional export channels, by building direct, long-term relationships with roasters.

Fazenda Paradiso is at the beginning of its journey, learning how to price, market, and sell independently. Sancoffee, by contrast, is already exporting at scale with a refined model of quality, consistency, service and award-winning microlots. Yet both are committed to organic, relationship-based growth, a model that helps them escape the constraints of the C-market.

This reflects what we see on Algrano every day: producers at different stages of growth using relationship-driven models to break free from price volatility, and build more sustainable businesses. Often alongside roasters who share their values. The strongest partnerships tend to form when roasters and producers have things in common: similar scale, age, community roles, and a shared entrepreneurial mindset.

The cost of going direct

Direct trade can offer producers better prices and more control than traditional export routes. But it also requires them to take on roles far beyond farming. They must become entrepreneurs, mastering logistics, pricing, customer service, and sales.

Marina of Fazenda Paradiso embodies this shift. When she moved to the U.S., she became her father’s commercial arm, helping sell a full container directly to roasters and, later, joining Algrano to list micro-lots. Building that independence required significant investment: time, learning, and nearly $100,000 in upfront capital.

“We’re taking passos de formiguinha, little ant steps.”

Producer-led pricing and sustainability

In theory, producer-led pricing is essential for a sustainable coffee industry. But in practice, most producers rarely get to set, let alone achieve, the prices they need.

In traditional trader-led models, pricing is often dictated by buyers or intermediaries who treat coffee as a commodity. Even in specialty markets, prices tend to be benchmarked against cupping scores or the C-market, limiting a producer’s ability to reflect the full value of their coffee. This system overlooks what producers call the extrinsic value of their lots: the story, effort, and investment that go beyond taste alone.

Vicente of Fazenda Paradiso, for example, knows what he needs to earn to run a viable business. His price reflects not just the cost of production, but also the ongoing investment in infrastructure, skilled labor, and marketing needed to grow sustainably. Yet those prices are difficult to achieve when selling locally or through traditional exporters.

The most consistent path to better prices comes through direct relationships, where producers and roasters build mutual understanding, long-term partnerships. On Algrano, producers can list their coffees at prices that account for both their current costs and future goals, giving producers more leverage and enabling more sustainable trade.

What happens when climate hits

In 2025, Fazenda Paradiso was hit hard. Extreme weather — heat, drought, and hail — devastated the crop. They expect to harvest only 30% of their normal volume.

With so little coffee to sell, producers face difficult choices. Do they prioritise buyers who pay fast, or those who offer better long-term prices? How do they maintain relationships when volumes are down? And how do they fund climate adaptation without compromising future production?

This has real consequences. Many cherries are hollow (chochos), trees are stressed, and sections of the farm had to be skeleton-pruned. They’re now seeking permits for a deep well and drip irrigation — urgent but costly adaptations to survive the next harvest.

Despite recent spikes in the C-market, most producers aren’t getting rich. Price increases rarely cover the true cost of lower yields, risk, and future resilience. In this case, Marina will offer micro-lots privately to existing roaster partners on Algrano, adjusting prices to reflect the scarcity and the reality on the ground.

"It’s not just about making coffee anymore. It’s about the farm survival."

.png)

Why this matters for the future of specialty

Farms like Fazenda Paradiso aren't the exception. They're the norm. And models like Sancoffee show what’s possible when long-term support is in place.

But neither can thrive without buyers who understand the full picture: the human stories, the economic trade-offs, and the long-term consequences of pricing.

That’s why platforms like Algrano exist: to bring producers closer to the people buying their coffee, and to help both sides make decisions with more context and more trust.

%201.png)

%201%402x.png)